difference between islamic capital market and conventional capital market

Name derives from the Avestan term aryanam meaning Land of the Noble Ones Government type. Strategic pricing is related.

Islamic Accounting Practices The Importance Of Islamic Capital Mark

It is asset based.

. Increasing market integrity and investor protection. Market abuse regulation. Conventional long form.

European Market Infrastructure Regulation. The key characteristic of Islamic economics is that economic and financial activities are linked to real economic sector activities and there is encouragement to equity based structures backed by tangible assets instead of debt based ones in investment. Read our latest stories including opinions here.

The goal has always been to leverage the EUs market to dictate terms to their energy suppliers. However conventional banks that operate in countries with a higher market share of Islamic banks are more cost-effective but less stable. By Andrew Ross Sorkin.

Before moving further is there a difference between Commodity Murabaha and Tawarruq. This creates shortage in open market and abundance in government. The central bank defines some rules which are specific to the Islamic banks.

Contact us by web chat email phone or post. Let us first understand the major difference between Islamic banking and conventional banking system. The profit is shared between the person providing the capital and the person providing the management expertise.

In this paper the concept of social capital is introduced and illustrated its forms are described the social structural conditions under which it arises are examined and it is used in an analysis of dropouts from high school. Difference Between Islamic Banking and Conventional Banking. The records of banks that have been involved in PLS show that they have usually provided higher returns to their depositors than those who have.

Islamic banking is an Ethical Banking System and its practices are based on Islamic Shariah laws. University of Technology and Applied Sciences-Nizwa UTAS-Nizwa is located on the eastern outskirts of Nizwa city about 12 km from the city centre. Interest in completely prohibited in Islamic banking.

Only 13 rd of the total cereal production is left for open market after government procurement and captive consumption by the farmers. Iran local long form. Like conventional lenders microfinanciers must charge interest on loans and they institute specific repayment plans with payments due at.

Who is responsible for the management and investment of the capital. In terms of the domestic political phenomena of contemporary India. Among the claims made for an Islamic economic system by Islamic activists and revivalists are that the gap between the rich and the poor will be reduced and prosperity enhanced by such means as the discouraging of the hoarding of wealth taxing wealth through zakat but not trade exposing lenders to risk through profit sharing and venture capital discouraging of hoarding of.

Value in a secondary market. Islamic and conventional banks. The main difference between conventional finance and Islamic finance is that some of the practices.

We cover Capital Celeb News within the sections Markets Business Showbiz Gaming and Sports. Microfinance Loan Terms. London E20 1JN Contact us.

Islamic Republic of Iran conventional short form. There is also consistent evidence of higher capitalization of Islamic banks and this capital cushion plus higher liquidity reserves explains the relatively better. This brings market prices atleast on par with MSP.

The events that ushered in the fourth period occurred between 1984 when Indira Gandhi was assassinated igniting communal clashes between Hindus and Sikhs mainly in the capital city of New Delhi and her son Rajiv Gandhi succeeded her as Prime Minister and 1989 when the Cold War structure collapsed. Jomhuri-ye Eslami-ye Iran local short form. Data suggests an obvious directly proportional link between hike in MSPs and Food Inflation.

More on MiFID II. Contact us by web. The profits are shared between the parties according to a pre-agreed ratio.

The only difference between Islamic banking and interest-based banking in this respect is that the cost of capital in interest-based banking is a predetermined fixed rate while in Islamic banking. Markets in Financial Instruments Directive II MiFID II Regulating investment services within the European Economic Area. Review into change and innovation in the unsecured credit market the Woolard Review Transparency.

Use of the concept of social capital is part of a general theoretical strategy discussed in the paper. Improving derivative market transparency. DealBook Newsletter The Newest Corporate Perk.

If conventional economics had continued to develop in the image of the Judeo-Christian worldview as it did before the Enlightenment Movement of the seventeenth and eighteenth centuries there may not have been any significant difference between conventional and Islamic economics. Need a Covid rapid test. The price decisions are crucial decisions of the management as they affect market competitiveness its return on capital investment and profitability Bahador 2019.

For example minimum capital requirements are higher to establish an Islamic bank than the conventional banks. Profit-and-loss sharing joint venture musharakah Musharakah is a form of a joint venture Joint Venture JV A joint venture JV is. Islamic banks have to pay more taxes and registration costs because it is asset-based banking and the bank has to own the goods it further sells which eventually are.

Military and financial clout was the means by which to enforce the ever-changing terms like any good Mafiosi would while simultaneously draining the US. 35 42 N 51 25 E time. Not many scholars made this distinction between these two terms but in the early days Bai Inah was a transaction done by 2-parties and Commodity Murabaha transactions was either a transaction among 3-parties Bank-Customer-Broker or 4-parties Bank-Customer-Broker A-Broker B.

They can however be used to purchase goods or services whose price is equal to the face value of the certificate. The German social market economy is the economic policy of modern Germany that steers a middle path between the goals of social democracy and capitalism within the framework of a private market economy and aims at maintaining a balance between a high rate of economic growth low inflation low levels of unemployment good working conditions public welfare and. Istisnaá Sukuk The purchase price of the goods may be less than the deferred price as this represents a trading transaction.

One solution is to work for the right big company. However after the Enlightenment Movement all intellectual disciplines in Europe. Taking rational action as a starting point but rejecting the.

Permission to transfer the debt contract from the financier to a supplier of goods and services must be. It is expressed as a ratio of profit.

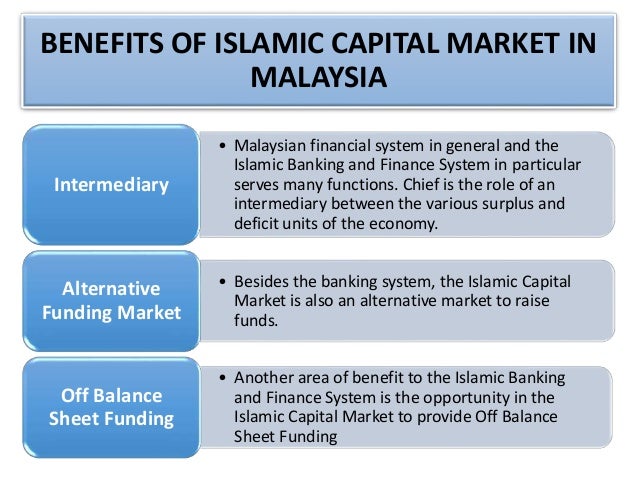

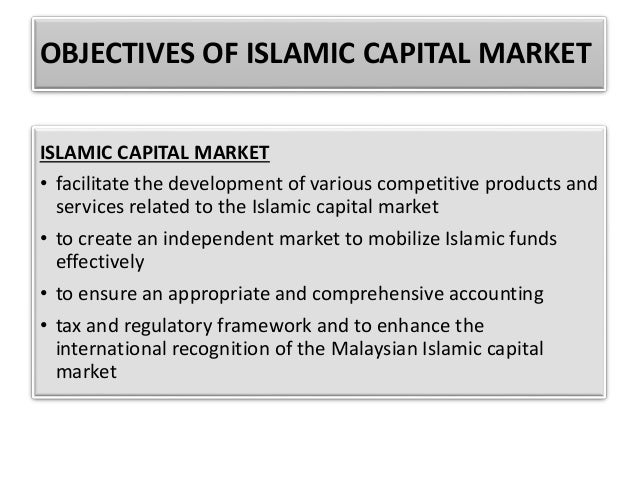

Islamic Capital Markets Main Function Is To Facilitate Transfer Of Investable Funds From Those Having Surplus To Those Requiring Funds Achieved By Selling Ppt Download

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

Islamic Accounting Practices The Importance Of Islamic Capital Mark

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

Modern Islamic Law Economics Islamic Charity Initiation

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

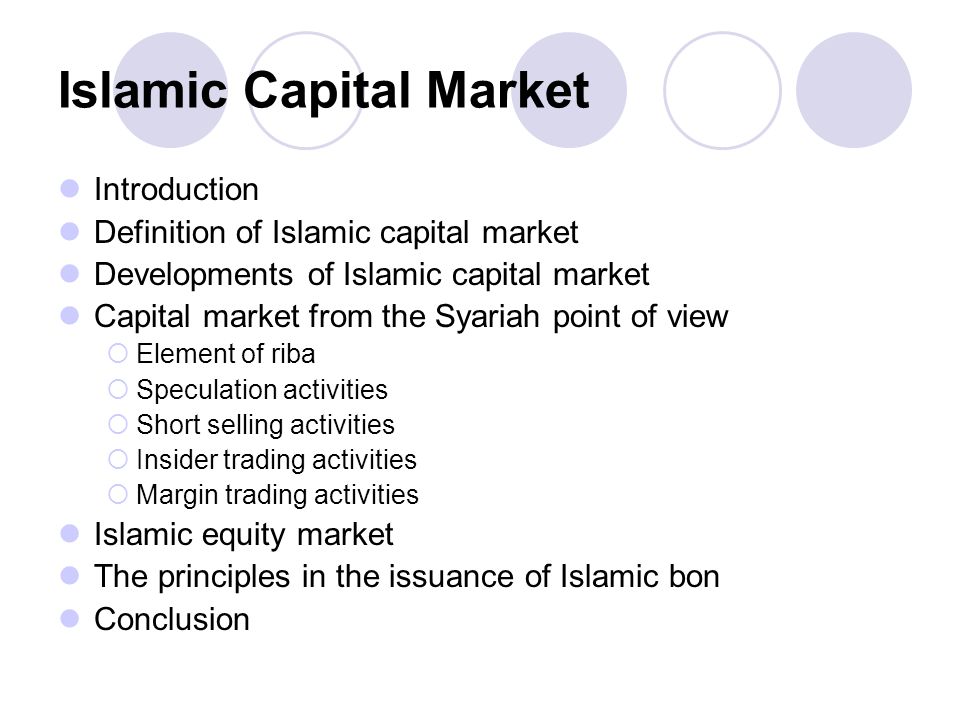

Islamic Capital Market Ppt Video Online Download

Islamic Accounting Practices The Importance Of Islamic Capital Mark

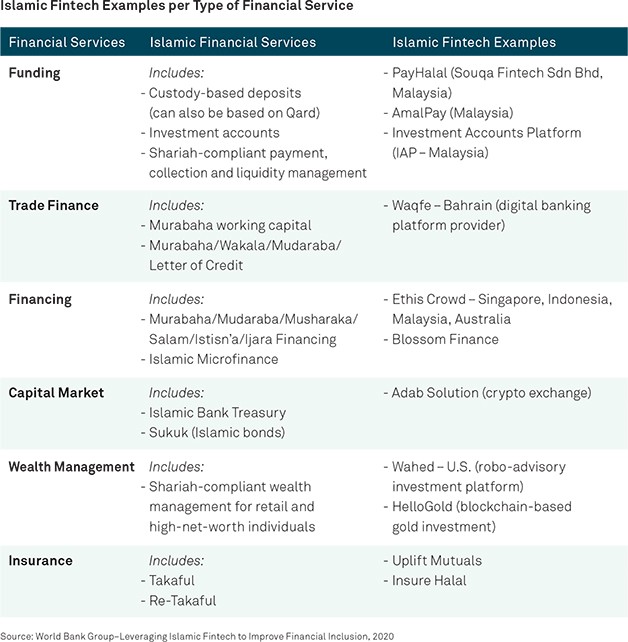

Pdf Islamic Finance Opportunities Challenges And Policy Options

The Growing Global Appeal Of Islamic Finance

Economic Growth And Financial Performance Of Islamic Banks A Camels Approach Emerald Insight

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

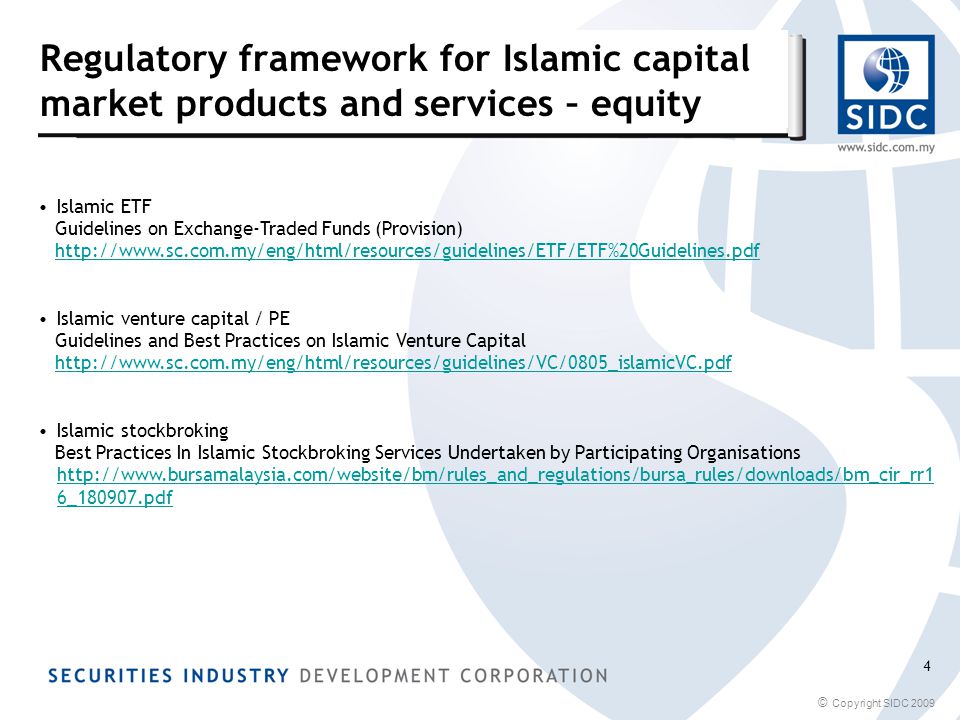

Overall Structure And Regulatory Framework Of Islamic Capital Market Ppt Download

Interdependence Between Islamic Capital Market And Money Market Evidence From Indonesia Sciencedirect

Islamic Accounting Practices The Importance Of Islamic Capital Mark

Pdf Islamic Capital Markets Developments And Issues

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Overall Structure And Regulatory Framework Of Islamic Capital Market Ppt Download